Global Plastic Recycling Market Size Analysis

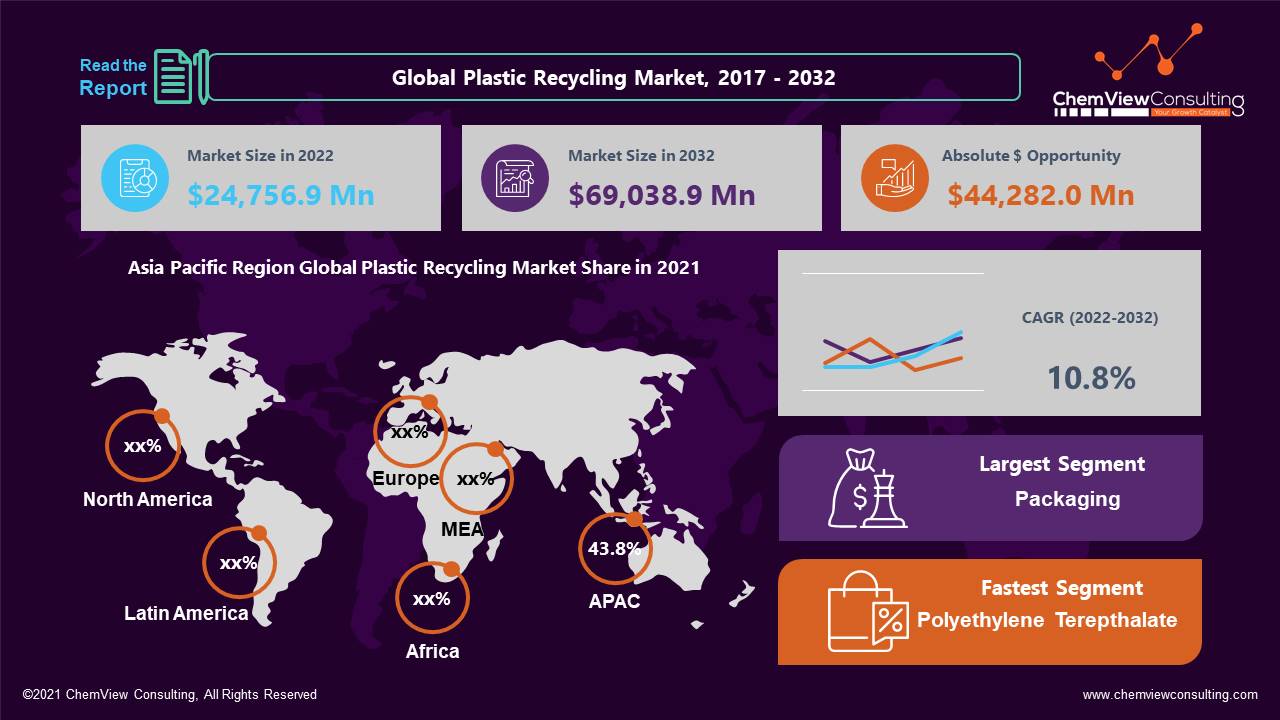

According to a research survey conducted by ChemView Consulting, in 2022, the Global Plastic Recycling Market was worth US$ 24,756.9 Mn and is expected to grow at a CAGR of 10.8% over the forecast period. While the historical CAGR is 9.7%, the market is expected to hit US$ 69,038.9 Mn by 2032 end.

Recycled plastic is scrap or waste plastic that has been turned into practical items. Recycling these materials is the best way to lessen the burden of polymers in the environment because most of the polymer materials used globally are non-biodegradable.

Increased public awareness has encouraged local governments and manufacturers to develop products made from recycled materials. The implementation of policies to reduce environmental impacts can have a significant impact on the recycling market. The efficiency of post-consumer packaging recycling could be significantly increased if the variety of materials were reorganised.

The Governmental actions in Brazil, China, India, and Europe are anticipated to encourage recycling. For instance, starting in 2021, the European Union intends to outlaw single-use polymer items. Additionally, the movement in end-use sectors, particularly packaging and consumer goods, favoring recyclable or sustainable materials, will fuel market expansion. Further, there will be an enormous increase due to the invention and development of items employing post-consumer recycled (PCR) plastics, such as packaging bottles, films, containers, and flatware.

Market Dynamic

INCREASING DEMAND FROM PACKAGING INDUSTRY TO DRIVE MARKET

The need for recycled materials is rising in many sectors, including food and beverage and consumer products. Due to the strong demand for packaging materials that are safe for use in food and beverages, the consumption of recyclable polymers is rising in this sector of the economy. As a barrier between food goods and environmental variables, these materials can efficiently replace traditional plastics, expanding the market. An excellent material that is highly preferred in the production of bottles for water and beverage packaging is recycled polyethylene terephthalate.

PREFERENCE FOR VIRGIN PLASTICS OVER THEIR RECYCLED ALTERNATIVES TO RESTRICT MARKET

The production of automotive components and food packaging are just two uses for virgin plastics. In terms of quality, they outperform their recycled counterparts by a wide margin. Although regulatory organizations have created directives to promote, the producers are hesitant to utilize PCR plastics in the packaging of their products because of the possibility of contaminants.

Furthermore, virgin polymers are favored in applications that call for particular chemical and additive combinations. Additionally, the pandemic led to a drop in crude oil prices, which decreased the cost of virgin plastics relative to recycled alternatives. The elements above are anticipated to limit market expansion during the study period.

Market Segments Covered in Report

By Product Type:

- Polyethylene (PE)

- Polyethylene Terephthalate (PET)

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)

- Polystyrene (PS)

- Others

By Application:

- Building & Construction

- Packaging

- Electrical & Electronics

- Textiles

- Automotive

- Others

By Region and Country:

- North America (U.S., Canada)

- Latin America (Brazil, Mexico, Rest of Latin America)

- Europe (Germany, Italy, France, UK, Spain, Netherlands, Norway, Russia, Rest of Europe)

- Asia-Pacific (China, Japan, South Korea, India, Indonesia, Thailand, Vietnam, Australia & New Zealand, Rest of Asia-Pacific)

- Middle East (Saudi Arabia, Turkey, UAE, Rest of Middle East)

- Africa (South Africa, Nigeria, Egypt, Rest of Africa)

Segment-Wise Analysis

Why does Polyethylene Terephthalate cover the largest segment?

The largest segment is Polyethylene Terephthalate, widely used in food packaging and bottling. Given that it is safe, light, strong, and easily recyclable, it is in high demand for use in food and beverage packaging. The restrictions imposed by numerous countries worldwide have made bottled water more expensive, and beverage makers have switched from using virgin PET to recycled PET for making packaging bottles. Additionally, recycled PET is used in the production of carpet, furniture, and fibers, which is anticipated to drive market growth.

Why does the Packaging Segment expect to be the profitable segment throughout the projection period?

Due to the significant demand for recycled PET in the production of bottles and other packaging goods like films and wraps, the packaging segment is anticipated to continue being the largest throughout the projection period. The fact that these polymers are typically less expensive than virgin plastics increases demand for the production of packaging products.

However, these plastics are also widely used in the packaging of food. Manufacturers of food look for materials that are not only suitable for handling food but also are affordable and sustainable. Recycled polymer satisfies these requirements, and manufacturers of food products have a high demand for recycled polymers.

Region-Wise Analysis

The regions analyzed for the market include North America, Europe, Latin America, Asia Pacific, the Middle East, and Africa.

- Due to China and India being the top two consumers of recycled plastic, the market in the Asia Pacific now has a market share of 8%. It is anticipated to continue to grow over the projected period. Numerous bottled water producers in the area lead to widespread plastic bottle consumption.

- There is a high demand for building goods in Europe, and the automotive business is expanding significantly. Regulations proposed by the European Union in 2021 to dramatically lower the use of single-use plastics in the area will boost industry growth.

Competition Analysis

Businesses compete in the market because of the technology used to recycle plastic trash. Major firms are expanding their plastic recycling and R&D facilities and developing their infrastructure, and they are also looking for ways to vertically integrate throughout the value chain. Such measures assist companies in meeting the rising demand for recycled plastics on a global scale, maintaining competitive effectiveness, enhancing operations planning, developing cutting-edge products and technology, lowering recycling costs, and growing their customer base.

Some of the key developments that have taken place in the Protective Coatings Market include:

- In May 2021, New recycling facilities were purchased by Plastipak Holdings for their construction site in Toledo, Spain. Beginning in early 2022, this facility will start producing food-grade recycled PET (rPET) pellets from PET flake for use in preforms, bottles, and containers. This facility will annually generate 20 kilotons of food-grade shells.

- In May 2020, Coca-Cola began using just 100% rPET packaging for all its tiny plastic bottles sold in Norway and the Netherlands. This will help the company’s global World Without Waste initiative. Additionally, the business intends to switch to 100% rPET in 2021 for its large plastic bottles.

A list of some of the key suppliers present in the market are:

- REMONDIS SE & Co. KG

- Biffa

- Stericycle

- Republic Services, Inc.

- WM Intellectual Property Holdings, LLC

- Veolia

- Shell International BV

- Waste Connections

- Clean Harbors, Inc.

- Coventry AG

Report Coverage and Highlights

- Our comprehensive, data-backed, and facts-oriented report provides niche and cross-sectional analysis at global and country levels.

- Assessment of the historical (actual data) and current market size (2017-2021), market projections (2022-2032), and CAGR.

- The market assessment across North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East, and Africa.

- Competitive tactical intelligence, key strategies adopted by top players, production capacity and company shares analysis, product brand surveys, and export-import analysis

- Pricing analysis to set and benchmark your current or future offerings across each product type helps you understand whether your pricing strategy is aligned with market expectations and can be compared to market disruptions.

- Predictions on critical supply and demand trends and technological expertise needed to address operations scalability.

- Consumer behavior shifts and their implications for players, list of end-users, and their consumption analysis.

- Key drivers, restraints, opportunities, and emerging trends impacting the market growth.

- Value chain analysis (list of manufacturers, distributors, end-users, and average profitability margins).

- Strategic market analysis, recommendations, and future headways on crucial winning strategies.

| Research Scope | Details |

| Forecast period | 2022-2032 |

| Historical data available for | 2017-2021 |

| Market analysis | USD Million for Value and Tons for Volume, and CAGR from 2022 to 2030 |

| Key regions covered | North America, Latin America, Europe, Asia-Pacific, Middle East, and Africa |

| Key countries covered | US, Canada, Brazil, Mexico, Germany, Italy, France, UK, Spain, Netherlands, Norway, Russia, China, Japan, South Korea, India, Indonesia, Thailand, Vietnam, Australia & New Zealand, Saudi Arabia, Turkey, UAE, South Africa, Nigeria, Egypt |

| Key segments covered | By Product Type, Application, and Region |

| Customization scope | Available upon Request |

| Pricing and purchase options | Available upon Request |