Global Oilfield Production Chemicals Market Size Analysis

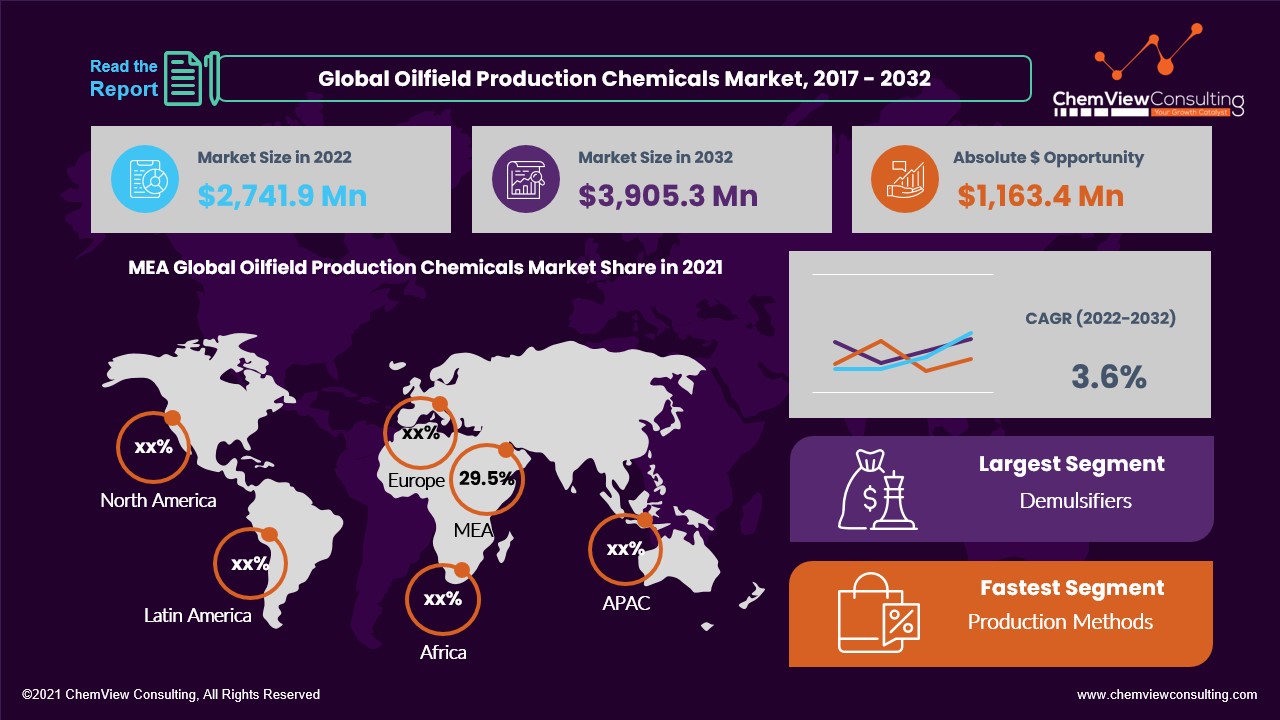

According to a research survey conducted by ChemView Consulting, in 2022, the Global Oilfield Production Chemicals Market was worth US$ 2,741.9 Mn and is expected to grow at a CAGR of 3.6% over the forecast period. While the historical CAGR is 2.9%, the market is expected to hit US$ 3,905.3 Mn by 2032 end.

Oil chemicals are used in oil and gas exploration and drilling to increase productivity and efficiency. Oilfield chemicals market growth is projected to be boosted by rising product demand in various petroleum operations such as well stimulation, drilling, cementing, production, hydraulic fracturing, and enhanced oil recovery.

The demand for various drilling projects is rising quickly due to increased oil production and exploration operations. Another significant class of chemicals used mostly during the exploration stage are drilling fluids. Drilling fluids perform various functions, such as maintaining the drill bit’s temperature and cleanliness to increase penetration level and applying hydrostatic pressure to stop formation fluids from entering wells.

Demulsifiers are frequently utilized in both onshore and offshore oil production operations. Demand is anticipated to rise due to rising onshore and offshore oil production activities. Demulsifiers made up 49.4% of the market’s value share in 2021 and are expected to increase to 51.2% by the end of 2032. A significant issue in oil production, particularly at offshore sites, is the separation of oil emulsion and water.

Demulsifiers play a substantial part in separating the water and oil emulsion to address this issue. The growing exploration of new oil reservoirs has led to a significant increase in the use of the demulsifier in onshore oilfield production activities.

Market Dynamic

PETROCHEMICALS TO SURGE GLOBAL OIL DEMAND TO OFFER MARKET GROWTH OPPORTUNITIES

Plastics like polyethylene, polypropylene, and polystyrene, among others, are created using a significant portion of the petrochemicals generated around the world. Over the past few decades, demand for these polymers has dramatically expanded, particularly in key end-use industries like plastic food and another commercial product packaging.

This upward tendency is likely to persist during the projected period, particularly in developing nations in the Asia Pacific, Latin America, and Africa. Food waste is decreased by the longer shelf life of plastics, resulting in less fuel being used to transport commodities. It provides many direct economic advantages and can help with resource optimization, which is essential for developing emerging economies.

Petrochemicals are anticipated to be the main driver of oil consumption during the projection period due to the demand for petrochemical products. Major nations that produce oil are aware of this trend and building petrochemical complexes to take advantage of the inexpensive raw resources at their disposal. Demand for petrochemicals is anticipated to increase with rising purchasing power and a better quality of life for people in emerging economies. The market will profit and grow as a result.

TRANSITIONING TO RENEWABLE ENERGY TO HAMPER MARKET GROWTH

During the forecast period, more vigorous action from governments worldwide is anticipated to speed up the switch to renewable energy. Due to the epidemic and the profound changes it brought about in the oil and gas industry, many nations are now concentrating on the possibility of long-term recovery to quicken the transition to a low-carbon future.

Since the fuel industry is the main demand generator, it is projected that further advancements in fuel efficiency, significantly higher penetration of electric vehicles, and new regulations limiting oil usage in the power sector will lower overall oil demand during the forecast period. These elements are anticipated to diminish the need for crude oil, which would hurt the industry expansion.

Market Segments Covered in Report

By Type:

- Demulsifiers

- Corrosion Inhibitors

- Paraffin Inhibitors

- Biocides

- Hydrate Inhibitors

- H2S Scavengers

- Scale Inhibitors

- Others

By Application:

- Production Methods

- Storage & Transportation

- Safe Disposal gas

By Region and Country:

- North America (U.S., Canada)

- Latin America (Brazil, Mexico, Rest of Latin America)

- Europe (Germany, Italy, France, UK, Spain, Netherlands, Norway, Russia, Rest of Europe)

- Asia-Pacific (China, Japan, South Korea, India, Indonesia, Thailand, Vietnam, Australia & New Zealand, Rest of Asia-Pacific)

- Middle East (Saudi Arabia, Turkey, UAE, Rest of Middle East)

- Africa (South Africa, Nigeria, Egypt, Rest of Africa)

Segment-Wise Analysis

How is the growth of the demulsifiers type of oilfield production chemicals segment expected to impact the market?

Over the projection period, the demulsifier segment is anticipated to expand at a special rate of 4.5% CAGR.

In both onshore and offshore oil production operations, demulsifiers are frequently utilized. Demand is anticipated to rise due to rising onshore and offshore oil production activities. Demulsifiers made up 49.4% of the market’s value share in 2021 and are expected to increase to 51.2% by the end of 2032.

A significant issue in oil production, particularly at offshore sites, is the separation of oil emulsion and water. Demulsifiers play a substantial part in separating the water and oil emulsion to address this issue. The growing exploration of new oil reservoirs has led to a significant increase in the use of the demulsifier in onshore oilfield production activities.

What are the prospects for the sale of Corrosion Inhibitors Oilfield Production Chemicals?

The corrosion inhibitor segment is expected to generate an absolute dollar opportunity of more than US$ 177.9 Mn from 2022 to 2028. Corrosion inhibitors are in high demand as crude oil demand rises. Corrosion inhibitors are critical in extending the life of oil production equipment.

Region-Wise Analysis

The regions analyzed for the market include North America, Europe, Latin America, Asia Pacific, the Middle East, and Africa.

- The Middle East has a market share of 5% and is experiencing strong growth. These markets are mostly attributable to rising drilling and oil exploration activities to meet the demand for natural gas and crude oil on a global scale. Due to Saudi Arabia’s advantageous location and proximity to other MEA nations, few businesses are considering local manufacturing there.

- According to projections, the U.S. will hold a significant portion of the world market for oilfield production chemicals. The entire North American market, particularly in the United States, is anticipated to be driven by well-established production facilities for chemicals and oils, important manufacturing businesses, and increasing investment in R & D activities.

Competition Analysis

Producers have shifted their attention in recent years to developing nations to address the rising demand for Oilfield Production Chemicals. Several significant firms are also concentrating on increasing their production capacities to meet the demand by discovering new oil sources. Market participants are stepping up their merger and acquisition efforts.

The key developments in the Global Oilfield Production Chemicals Market are:

- In June 2018, the Baker Hughes business reopened its oil and gas technology centre in Oklahoma City, North America, to improve innovation, commercialization, and productivity.

- In May 2021, NOV and Schlumberger worked together to promote the use of drilling contractors and oil and gas operators to offer automated training systems. The strategic alliance will increase safety, automate manual procedures, and increase the effectiveness of drilling operations.

- In November 2020, by purchasing a 0% share in OPT Petroleum Technologies Company Limited, The Industrialization and Energy Services Company (TAQA) increased the scope of its oilfield chemicals offerings.

A list of some of the key suppliers present in the market are:

- Arkema S.A

- Clariant AG

- BASF SE

- Halliburton Co.

- Albemarle Corporation Company

- Huntsman Corporation

- ECOLAB Inc.

- Solvay S.A.

- Hexion Inc.

- Baker Hughes

- Akzo Nobel N.V

- Ashland Global Holdings Inc.

- Dow Dupont Inc.

Report Coverage and Highlights

- Our comprehensive, data-backed, and facts-oriented report provides niche and cross-sectional analysis at global and country levels.

- Assessment of the historical (actual data) and current market size (2017-2021), market projections (2022-2032), and CAGR.

- The market assessment across North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East, and Africa.

- Competitive tactical intelligence, key strategies adopted by top players, production capacity and company shares analysis, product brand surveys, and export-import analysis

- Pricing analysis to set and benchmark your current or future offerings across each product type helps you understand whether your pricing strategy is aligned with market expectations and can be compared to market disruptions.

- Predictions on critical supply and demand trends and technological expertise needed to address operations scalability.

- Consumer behavior shifts and their implications for players, list of end-users, and their consumption analysis.

- Key drivers, restraints, opportunities, and emerging trends impacting the market growth.

- Value chain analysis (list of manufacturers, distributors, end-users, and average profitability margins).

- Strategic market analysis, recommendations, and future headways on crucial winning strategies.

| Research Scope | Details |

| Forecast period | 2022-2032 |

| Historical data available for | 2017-2021 |

| Market analysis | USD Million for Value and Tons for Volume, and CAGR from 2022 to 2030 |

| Key regions covered | North America, Latin America, Europe, Asia-Pacific, Middle East, and Africa |

| Key countries covered | US, Canada, Brazil, Mexico, Germany, Italy, France, UK, Spain, Netherlands, Norway, Russia, China, Japan, South Korea, India, Indonesia, Thailand, Vietnam, Australia & New Zealand, Saudi Arabia, Turkey, UAE, South Africa, Nigeria, Egypt |

| Key segments covered | By Type, Application, and Region |

| Customization scope | Available upon Request |

| Pricing and purchase options | Available upon Request |