Lithium Ion Battery Recycling Market Size Analysis

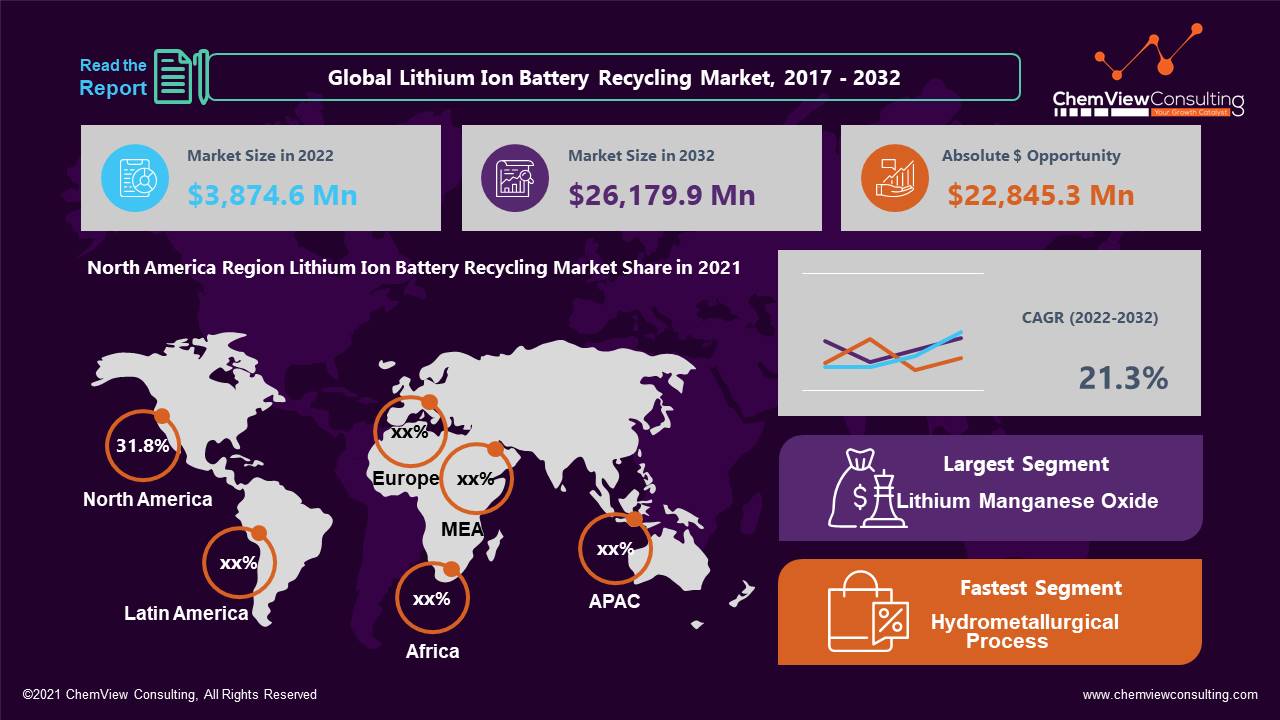

According to a research survey conducted by ChemView Consulting, in 2022, the Global Lithium Ion Battery Recycling Market was worth US$ 3,874.6 Mn and is expected to grow at a CAGR of 21.3% over the forecast period. While the historical CAGR is 4.1%, the market is expected to hit US$ 26,719.9 Mn by 2032 end.

The rapid adoption of lithium-ion batteries suggests that they will remain a prominent source of clean energy for at least the next decade, particularly in the electromobility field. Given the current and anticipated trends, a massive dominance of lithium-ion batteries is to be expected. The increased consumption of lithium-ion batteries emphasises the importance of disposing of batteries that have reached the end of their useful life. The majority of batteries end up in landfills and pose a threat to the environment.

As a result, recycling lithium-ion batteries has become critical in developing a closed loop system in which recovered materials can be reused in batteries, assisting in meeting the rising demand for raw materials in the battery.

One of the main drivers driving the market for lithium-ion battery recycling is the rising demand for electric cars throughout the world, together with subsidies offered by governments of different nations for battery recycling. Due to worries about the environmental harm caused by vehicles running on conventional energy sources like diesel and petrol, there has been a considerable increase in demand for electric cars. One of the key drivers is the declining cost of batteries for electric vehicles.

Market Dynamic

THE NECESSITY FOR EFFICIENT WASTE MANAGEMENT SYSTEMS TO SUPPORT THE MARKET GROWTH

The demand for battery recycling is anticipated to increase throughout major economies due to strict government rules for safe battery disposal and bottlenecks in the supply of raw materials. Compared to the expected demand from diverse end-use sectors, the resources available for creating new batteries are few. To reduce harmful environmental effects, efficient waste management and the recovery of precious minerals and metals from batteries are both vital. Manufacturing recycled batteries using recovered metal can significantly reduce CO2 emissions and the energy needed for mining.

RISKS ASSOCIATED WITH BATTER USAGE HAMPER THE MARKET GROWTH

Hazardous battery compounds include acids and heavy metals like mercury and lead. Used batteries retain some of their charge, which increases the risk of an unintentional discharge that might harm or damage both persons and property. Large lithium-based batteries, such as those employed in automotive applications, may be mislabeled as lead-acid batteries by regional battery producers. Due to these problems, state or federal governments restrict the transportation and storage of expended batteries.

COVID-19 Impact

Most markets are experiencing declines due to the COVID-19 epidemic, and non-essential manufacturing facilities are gradually being forced to shut down temporarily. Due to multiple lockdowns implemented by numerous nations in response to the second and third waves of the pandemic, the manufacture and consumption of lithium-ion batteries have decreased to a greater extent than anticipated in the short term, negatively affecting the lithium-ion battery recycling market.

One of the main end-use markets for lithium-ion batteries, the electric vehicle industry, has been negatively impacted by COVID-19, which is expected to have a minor influence on the lithium-ion battery recycling business.

Market Segments Covered in Report

By Chemistry:

- Lithium-nickel Manganese Cobalt (Li-NMC)

- Lithium-iron Phosphate (LFP)

- Lithium-manganese Oxide (LMO)

- Lithium-titanate Oxide (LTO)

- Lithium-nickel Cobalt Aluminum Oxide (NCA)

By Application:

- Transportation

- Consumer electronics

- Industrial

By Recycling Process:

- Hydrometallurgical Process

- Pyrometallurgy Process

- Physical/ Mechanical Process

By Region and Country:

- North America (U.S., Canada)

- Latin America (Brazil, Mexico, Rest of Latin America)

- Europe (Germany, Italy, France, UK, Spain, Netherlands, Norway, Russia, Rest of Europe)

- Asia-Pacific (China, Japan, South Korea, India, Indonesia, Thailand, Vietnam, Australia & New Zealand, Rest of Asia-Pacific)

- Middle East (Saudi Arabia, Turkey, UAE, Rest of Middle East)

- Africa (South Africa, Nigeria, Egypt, Rest of Africa)

Segment-Wise Analysis

Why is Lithium-nickel manganese cobalt Lithium Ion Battery Recycling projected to expand in the market at the highest rate?

Due to its expanding use in energy storage systems and the automotive industry in e-bikes and other electric vehicles, the lithium-nickel manganese cobalt category had the greatest proportion of the lithium-ion battery recycling market. Lithium-nickel manganese cobalt (Li-NMC) batteries are in high demand because of their low cost, high energy density, and extended life cycle.

Region-Wise Analysis

The regions analyzed for the market include North America, Europe, Latin America, Asia Pacific, Middle East, and Africa.

- In 2021, North America led the lithium-ion battery industry, and it is anticipated that it will continue to do so between 2022 and 2032. The US is one of North America’s biggest markets for recycling lithium-ion batteries. During the forecast period, the market for lithium-ion battery recycling is anticipated to develop due to the expansion of electric cars in the area and government laws about lithium-ion battery recycling.

- The market for electric vehicles in the area will be improved by rising investments from major industry participants and expanding infrastructure for electric cars, which will favorably affect the lithium-ion battery recycling industry.

- Asia Pacific is anticipated to have the quickest CAGR of 8.4% throughout the projected period. Due to the increasing demand from end-use sectors like the automobile, nations like China, India, and Japan are predicted to see rapid development.

Competition Analysis

The sector is very competitive, with many international recyclers operating their companies through huge production volumes. From the gathering of used batteries to the sales and distribution in various areas, the businesses in the worldwide market are very intertwined.

To strengthen their positions in the market, the participants have used partnerships, investments, contracts, partnerships, acquisitions, new technological advancements, expansions, and new production tactics.

Some of the key developments that have taken place in the Lithium Ion Battery Recycling Market include:

- In June 2021, Retriev Technologies signed a partnership with Marubeni Corporation to develop an innovative business model for end-of-life Lithium-ion batteries.

- In February 2022, Glencore and Britishvolt signed a strategic agreement to create a world-class battery recycling ecosystem in the UK.

A list of some of the key suppliers present in the market are:

- Glencore

- Retriev Technologies

- Umicore

- Saubermacher Dienstleistungs AG

- American Manganese Inc.

- Li-Cycle Corp

- Akkuser Oy

- TES

- Fortum

- Contemporary Amperex Technology Co.

- Limited, GEM Co., Ltd.

- Ganfeng Lithium Co., Ltd.

- Attero

- ACCUREC-Recycling GmbH

- Duesenfeld GmbH

- Tata Chemicals Ltd.

- OnTo Technology LLC

- Lithion Recycling

- ECOBAT

- Cawleys

- Veolia Environnement SA

- Batrec Industrie

- Nickelhütte Aue GmbH

- Neometals Ltd

- Redwood Materials

- & Envirostream Australia Pty Ltd.

Report Coverage and Highlights

- Our comprehensive, data-backed, and facts-oriented report provides niche and cross-sectional analysis at global and country levels.

- Assessment of the historical (actual data) and current market size (2017-2021), market projections (2022-2032), and CAGR.

- The market assessment across North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East, and Africa.

- Competitive tactical intelligence, key strategies adopted by top players, production capacity and company shares analysis, product brand surveys, and export-import analysis

- Pricing analysis to set and benchmark your current or future offerings across each product type helps you understand whether your pricing strategy is aligned with market expectations and can be compared to market disruptions.

- Predictions on critical supply and demand trends and technological expertise needed to address operations scalability.

- Consumer behavior shifts and their implications for players, list of end-users, and their consumption analysis.

- Key drivers, restraints, opportunities, and emerging trends impacting the market growth.

- Value chain analysis (list of manufacturers, distributors, end-users, and average profitability margins).

- Strategic market analysis, recommendations, and future headways on crucial winning strategies.

| Research Scope | Details |

| Forecast period | 2022-2032 |

| Historical data available for | 2017-2021 |

| Market analysis | USD Million for Value and Tons for Volume, and CAGR from 2022 to 2032 |

| Key regions covered | North America, Latin America, Europe, Asia-Pacific, Middle East, and Africa |

| Key countries covered | US, Canada, Brazil, Mexico, Germany, Italy, France, UK, Spain, Netherlands, Norway, Russia, China, Japan, South Korea, India, Indonesia, Thailand, Vietnam, Australia & New Zealand, Saudi Arabia, Turkey, UAE, South Africa, Nigeria, Egypt |

| Key segments covered | By Chemistry, Application, Recycling Process, and Region |

| Customization scope | Available upon Request |

| Pricing and purchase options | Available upon Request |