Industrial Cleaners Market Outlook

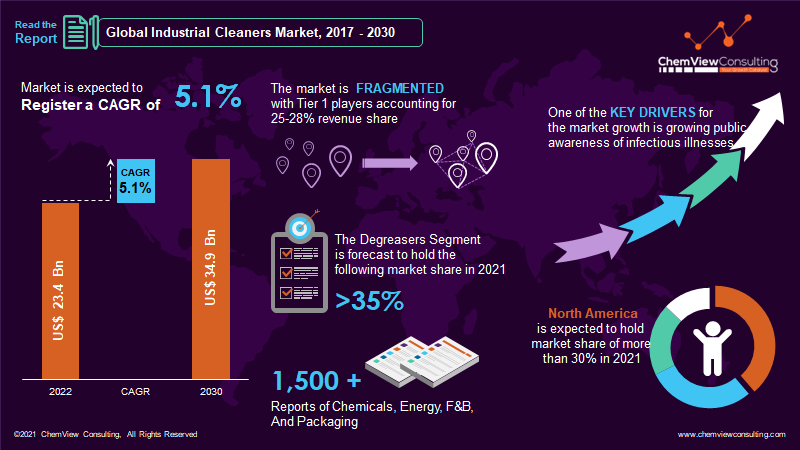

According to ChemView Consulting’s survey, the global Industrial Cleaners market accounted for US$ 23.4 Bn in 2021. Driven by increasing demand for degreasers, expanding healthcare spending throughout the world, the introduction of stringent sanitation and hygiene regulations for the food processing industry, and rising investments in the retail sector, the market is predicted to increase at a CAGR of 5.1% between 2022 and 2030.

Considering this, ChemView Consulting has projected the global market to reach US$ 34.9 Bn in 2030.

| Estimated Year Market Value (2021E) | US$ 23.4 Bn |

| Projected Year Market Value (2031F) | US$ 34.9 Bn |

| Global Market CAGR (2022-2030) | 5.1% |

| Market Share of the Largest Region: North America | >30% |

| Market Share of Largest Segment: Degreasers | >35% |

Key Market Insights

- Degreasers and surfactants make up the majority of the product type in the industrial cleaners market.

- Regarding product type, general-purpose cleaning products are the most popular in the industrial and institutional cleaning chemicals market. This segment’s goods are mostly utilized in hospitals, hotels, and workplaces as ware-wash, floor cleaners, and other similar applications.

- One of the driving forces behind industrial cleaners is public awareness of infectious illnesses. However, the market’s expansion is stifled by the hazardous side effects of these substances.

- The need for disinfectants and other industrial cleaners is predicted to rise across many production industries, particularly in the chemical, food, and textile industries, as people become more conscious of cleanliness and the need for disinfection.

- The United States is the largest market stakeholder, followed by Western European nations. Due to its rising population, the Asia-Pacific area is seeing stable expansion.

- In response to the COVID-19 epidemic, the government is actively encouraging the use of cleaning chemicals as a preventative strategy. Despite the shutdown, cleaning chemical production factories around the country have continued running to accommodate rising demand during the epidemic.

Market Segmental Analysis: By Type, Mode of Distribution, End-Use Industry, By Region

- Based on product type, the market is further bifurcated into chelating agents solubilizers, PH regulators, solvents, surfactants, acid cleaners, de-foaming agents, disinfectants, degreasers, deodorizers, decontaminants, spill clean-up, and others. In the global industrial cleaners market, the degreasers segment is likely to stay dominant. Due to the wide uses of degreasers in various end-use sectors, demand for degreasers is predicted to rise and stay common compared to other industrial cleaners. Degreasers are often used to remove grease and other contaminants from the surfaces of machinery and equipment with moving components.

- Based on the end-use industry, the market is further bifurcated into oil & gas, petrochemicals, power generation, metallurgy, chemicals, food processing, paper & print, sugar, textiles, pharmaceutical, and others. The recovery of oil and gas prices has aided the rise of the oil and gas industry, which has boosted demand for industrial cleaners in this sector. Due to the increase in urban population and industrialization throughout developing nations, other manufacturing industries such as consumer goods and automobiles are seeing exponential expansion.

- Regionally, the Industrial Cleaners market has been segmented into North America, Latin America, Europe, Asia-Pacific, Middle East, and Africa. North America is anticipated to dominate the market due to the presence of a large number of industries in the region. In terms of market growth, China is expected to be a major player in the industrial cleaners industry. The ever-expanding Chinese economy, together with the region’s growing number of manufacturing enterprises, is likely to drive increased demand for industrial cleaners.

Competition Assessment

Due to the presence of a large number of global and local companies across various geographies, the global industrial cleaners market is highly fragmented. Tier-I players account for roughly 25-28 % of the worldwide industrial cleaners market, with the remaining 72-75 % being accounted for by other global and domestic businesses.

Some of the key players present in the global Industrial Cleaners market are:

- BASF SE

- The Dow Chemical Company

- Croda International Plc

- Huntsman Corporation

- Evonik Industries AG

- Mitsubishi Chemical Holdings Corporation

- Solvay S.A.

- Akzo Nobel N.V.

- Clariant

- Ecolab

- 3M Company

- Stepan Company

- Quaker Chemical Corporation

- Kao Chemicals GmbH

- Neos Company Limited

- WVT Industries

Key Developments in Industrial Cleaners Market

| In 2021, Diversey Holdings, Ltd. announced the signing of an agreement to purchase Tasman Chemicals. Tasman Chemicals also provides hygiene and cleaning chemicals to various industries, including institutional and others. | In 2021, Azelis has announced that it has reached a deal to buy the distribution assets of Indian businesses Spectrum Chemicals and Nortons Exim Private Limited, both of which provide cleaning chemicals for industrial use. As a result, the purchase will help Azelis grow its industrial cleaning chemical business. |

| In 2021, LANXESS finalized the purchase of INTACE SAS, a biocide firm situated in Paris, which will help expand the company’s product line. | In 2019, Nouryon has decided to quadruple capacity at its surfactants factory in Stenungsund, Sweden, to support the expansion of numerous established products as well as new sustainable technologies for sectors such as oil and gas, lubricants and fuels, and asphalt. |

Segments Covered in Report

By Product Type:

- Chelating Agents

- Solubilizers

- PH Regulators

- Solvents

- Surfactants

- Acid Cleaners

- De-foaming Agents

- Disinfectants

- Degreasers

- Deodorizers

- Decontaminants

- Spill Cleanup

- Others

By End-Use Industry:

- Oil & Gas

- Petrochemicals

- Power Generation

- Metallurgy

- Chemicals

- Food Processing

- Paper & Print

- Sugar

- Textiles

- Pharmaceutical

- Others

By Region and Country:

- North America (U.S., Canada)

- Latin America (Brazil, Mexico, Rest of Latin America)

- Europe (Germany, Italy, France, UK, Spain, Netherlands, Norway, Russia, Rest of Europe)

- Asia-Pacific (China, Japan, South Korea, India, Indonesia, Thailand, Vietnam, Australia & New Zealand, Rest of Asia-Pacific)

- Middle East (Saudi Arabia, Turkey, UAE, Rest of Middle East)

- Africa (South Africa, Nigeria, Egypt, Rest of Africa)

Global Industrial Cleaners Market 2022-2030: Report Coverage and Highlights

- Assessment of the historical and current Industrial Cleaners market size (2017-2021), market projections (2022-2030), and its contribution to the parent market

- Key drivers and restraints impacting market growth

- Predictions on Critical Supply, Demand, and Technological trends and changes in consumer behavior

- Market Opportunity Analysis

- Value Chain Analysis (List of Manufacturers, Distributors, Average Margins, etc.)

- Segment-wise, Country-wise, and Region-wise Analysis

- Competition Mapping, Benchmarking, and Advantage Analysis

- Market Share Analysis and Key Strategies Adopted by Top Players

- Key Product Innovations and Regulatory Climate

- Primary insights to understand what will shape the market growth over the next decade

- COVID-19 Impact on Industrial Cleaners Market and How to Navigate

- Strategic Success Factors and Recommendations on Key Winning Strategies

| Research Scope | Details |

| Forecast Period | 2022-2030 |

| Historical Data Available for | 2017-2021 |

| Market Analysis | USD Million for Value and Kilo Tons for Volume, and CAGR from 2021 to 2031 |

| Key Regions Covered | North America, Latin America, Europe, Asia-Pacific, Middle East, and Africa |

| Key Countries Covered | US, Canada, Brazil, Mexico, Germany, Italy, France, UK, Spain, Netherlands, Norway, Russia, China, Japan, South Korea, India, Indonesia, Thailand, Vietnam, Australia & New Zealand, Saudi Arabia, Turkey, UAE, South Africa, Nigeria, Egypt |

| Key Segments Covered | Product Type, End-Use Industry |

| Customization scope | Available upon Request |

| Pricing and purchase options | Available upon Request |