Global Flare Gas Recovery System Market Size Analysis

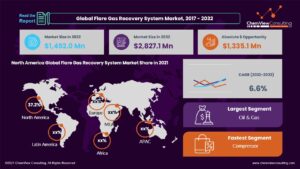

According to a research survey conducted by ChemView Consulting, in 2022, the Global Flare Gas Recovery System Market was worth US$ 1,492.0 Mn and is expected to grow at a CAGR of 6.6% over the forecast period. While the historical CAGR is 6.0%, the market is expected to hit US$ 2,827.1Mn by 2032 end.

Since the release of unburned gas results in a rise in carbon emissions flare, gas recovery devices are employed across the refinery industry for maintenance and safety purposes. Flare systems are deployed throughout refineries to reduce these emissions since they effectively stop the escape of unburned gases.

Every hydrocarbon processing sector needs a flare system to burn the vent gases before they are released into the atmosphere. Flare systems are necessary for safe and effective operational purposes. Among flare gas recovery systems’ most important end customers are refineries, gas processing facilities, and gas-producing facilities.

Market Dynamic

THE RISING NEED TO REDUCE CARBON EMISSIONS HAS BOOSTED THE ADOPTION OF FLARE GAS RECOVERY SYSTEMS

Refineries have adopted flare gas recovery systems in response to the growing need to minimize carbon emissions, which is projected to accelerate the market growth for these systems. Flare gas recovery systems recover unused gas from production facilities, which then inject the gas back into the production well to produce electricity.

HIGH CAPITAL INVESTMENT IN THE FLARE GAS RECOVERY SYSTEM HAMPERS THE GROWTH

Flare gas recovery systems require a high capital investment because selling a system involves the design, production, installation, and test runs, all of which raise the system’s ultimate cost. Over the projected period, this factor is anticipated to limit the use of a flare gas recovery system.

Market Segments Covered in Report

By Operating Pressure:

- Up to 5 bar (small)

- 5 to 10 bar (medium)

- 10 to 20 bar (large)

- 20 to 60 bar ( very large)

By Configuration:

- Modular

- Skid Mounted

By Technology:

- Compressor

- Ejector Based

By Flow Rate:

- Upto 2 MMSCFD

- 2 to 5 MMSCFD

- 5 TO 10 MMSCFD

- 10 TO 20 MMSCFD

- 20 to 50 MMSCFD

By Application:

- Oil & Gas

- Chemical Plants

- Storage Tanks

- Bio Gas & Landfill

- Industrial flue gas treatment

By Region and Country:

- North America (U.S., Canada)

- Latin America (Brazil, Mexico, Rest of Latin America)

- Europe (Germany, Italy, France, UK, Spain, Netherlands, Norway, Russia, Rest of Europe)

- Asia-Pacific (China, Japan, South Korea, India, Indonesia, Thailand, Vietnam, Australia & New Zealand, Rest of Asia-Pacific)

- Middle East (Saudi Arabia, Turkey, UAE, Rest of Middle East)

- Africa (South Africa, Nigeria, Egypt, Rest of Africa)

Segment-Wise Analysis

Why do the compressors remain highly sought-after?

Compressors are anticipated to become the most popular technology in the global flare gas recovery market. It is the most popular option for gas recovery applications because of its straightforward and small construction, low-pressure fluctuation, and compression.

Over the projected period, the sector is anticipated to represent over 44.8% of the flare gas recovery systems market.

Which application accounts for dominant share in flare gas recovery systems market?

By 2032, the oil and gas industry is anticipated to hold more than 60.0% market share for flare gas recovery systems. These systems are necessary for flare gas recovery in several sectors, including petrochemical refineries, NGL facilities, fuel gas conditioning, and others in the oil and gas sector.

Region-Wise Analysis

The regions analyzed for the market include North America, Europe, Latin America, Asia Pacific, the Middle East, and Africa.

- Through 2032, the U.S. is anticipated to hold more than 76.0% of the North American market. With gas flaring reducing by 32.1% between 2019 and 2020 due to an 8.0% loss in oil output and new infrastructure to utilize gas that would otherwise be flared, the U.S. was responsible for 70.1% of the global flaring decline. This shows that regulations have been implemented well and that the nation uses more renewable energy.

- Over the projection period, demand is anticipated to grow in the Middle East and Africa at a rate of roughly 5.0% CAGR. Regarding consumption, nations like Qatar, Saudi Arabia, Algeria, and Tunisia have become significant players in the flare gas recovery system industry.

Competition Analysis

The number of acquisitions and growth operations has increased over the last few years, which has helped to increase the supply of the Flare Gas Recovery System. Another major focus is enhancing the Flare Gas Recovery System’s effectiveness for varied applications. Several manufacturers have also emerged, particularly in China, in the worldwide marketplace.

The key developments in the Global Flare Gas Recovery System Market are:

- In 2020, Zeeco, Inc. stated that Saudi Aramco had given Zeeco 9COM approval for a range of combustion equipment produced at the Dammam facility of Zeeco Middle East, Ltd.

- In 2018, Busch Vacuum Pumps and Systems declared that the engineering firm NSB Gas Processing, based in Switzerland, had joined its organization. Busch NSB AG has taken the place of NSB Gas Processing. Flare gas recovery systems are a sub-sector of the oil and gas industry, and the Busch NSB product line includes a wide range of these systems.

A list of some of the key suppliers present in the market are:

- Honeywell UOP

- Cimarron Energy, INC.( Jordan Technologies)

- Wärtsilä

- Zeeco, Inc

- SoEnergy International

- John Zink Hamworthy Combustion

- Ramboll Group, Inc.

Global Flare Gas Recovery System Market 2022-2032: Report Coverage and Highlights

- Assessment of the historical and current market size (2017-2021), market projections (2022-2032), and its contribution to the parent market

- Key drivers, restraints, opportunities, and key emerging trends impacting market growth

- Predictions on critical supply, demand, and technological trends and changes in consumer behavior

- Value chain analysis (list of manufacturers, distributors, end-users, average profitability margins, etc.)

- Segment-wise, country-wise, and region-wise market analysis

- Competition mapping, market share analysis, key strategies adopted by top players, and competitive tactical intelligence

- Key product innovations and regulatory framework

- Covid-19 impact on the market and how to navigate

- Strategic market analysis and recommendations on crucial winning strategies

| Research Scope | Details |

| Forecast period | 2022-2032 |

| Historical data available for | 2017-2021 |

| Market analysis | USD Million for Value and Tons for Volume, and CAGR from 2022 to 2030 |

| Key regions covered | North America, Latin America, Europe, Asia-Pacific, Middle East, and Africa |

| Key countries covered | US, Canada, Brazil, Mexico, Germany, Italy, France, UK, Spain, Netherlands, Norway, Russia, China, Japan, South Korea, India, Indonesia, Thailand, Vietnam, Australia & New Zealand, Saudi Arabia, Turkey, UAE, South Africa, Nigeria, Egypt |

| Key segments covered | By Operating Pressure, Configuration, Technology, Flow Rate, Application, and Region |

| Customization scope | Available upon Request |

| Pricing and purchase options | Available upon Request |