Drywall & Building Plaster Market Size Analysis

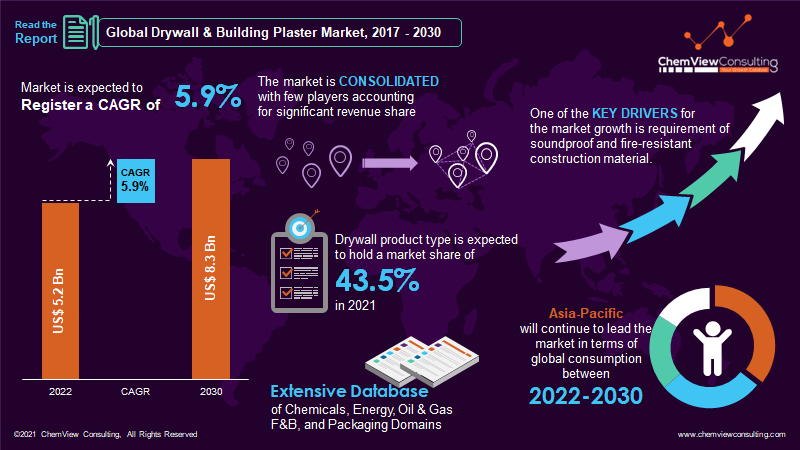

According to research conducted by ChemView Consulting, in 2022, the worldwide Drywall & Building Plaster Market was worth US$ 5.2 Bn and is expected to grow at a CAGR of 5.9% over the forecast period. The market is expected to hit US$ 8.3 Bn by 2030 end.

Drywall, also known as dry lining and plasterboard, is a material that is commonly used as an alternative to plaster in the construction of walls and ceilings. It is primarily made from gypsum, a mined mineral.

Because of its superior characteristics and ease of application, drywall has grown in popularity compared to other construction materials such as cement concrete, making it a viable alternative.

Market Dynamic

Which is the Key Factor driving the demand for Drywall & Building Plaster Market?

The Global Drywall & Building Plaster Market has grown rapidly due to the expansion of construction activities globally. With the worldwide construction industry expected to grow, the innovation of drywall-based construction techniques is likely to expand. It is expected to boost the market for drywall and building plasters significantly.

Drywall is extremely useful in terms of fire resistance, sound reduction, and improving the lives of nonresidential and residential civil constructions. Drywall ceiling installation necessitates thinner sheets than wall installation because they are less heavy and thus easier to install.

Drywall can outperform plaster in terms of drying time, and walls and ceilings that would take weeks to plaster can be completed in days using drywall.

What are the opportunities in the Drywall & Building Plaster Market business?

Economic growth in certain countries is expected to fuel residential and commercial infrastructure investments, significantly driving the market growth. Demand for drywall and building plasters is directly related to developments in the construction industry.

Drywall and building plasters are widely used in new building construction and upgrading, maintaining, and repairing old residential and nonresidential structures. This surge, in turn, is expected to create significant opportunities in the coming years.

Segment-Wise Analysis

Which segment type between Drywall & Building Plaster Market is estimated to grow at a high CAGR?

The Drywall segment is expected to have the highest CAGR during the forecast period and is expected to have a total market share of 43.5% in 2021. The growth factors attributed to the segment are associated with increased construction activities worldwide. This increased construction activity will boost drywall-based construction techniques.

Drywall, also known as wallboard, gypsum board, or plasterboard, is a panel made of calcium sulfate dihydrate (gypsum), with or without additives, that is normally pressed between two thick sheets of paper called a facer and a backer. These drywalls are commonly used to construct ceilings and interior walls.

Which application type creates the highest demand for Drywall & Building Plaster Market?

The residential segment is expected to grow fastest during the forecast period. Drywalls are important in residential properties because they increase the aesthetic appeal while also leading interior heat through thermal insulation provided by false ceilings.

Which region is consolidating its Drywall & Building Plaster Market dominance worldwide?

Due to several massive ongoing and upcoming construction projects in countries such as China and India, the Asia Pacific market is expected to remain dominant through the forecasted period. Furthermore, due to its high growth rate and size in the building construction market, the region has shown a higher demand for drywall and building plasters than other regions.

Demand for drywall in China is expected to grow more than 7.0% per year during this period, boosted by significant increases in residential and nonresidential construction spending. As drywall gains popularity over traditional building materials, it is expected to be used more frequently in residential applications in China.

Competition Analysis

Prominent Drywall & Building Plaster manufacturers are focusing on expansion by establishing new plants that will allow them to increase their production capacities and gain access to new distribution networks, which is expected to increase their customer base. Furthermore, they are working on expanding their product portfolio through strategic acquisitions and mergers to reach the broadest possible consumer base.

Some of the key developments that have taken place in the Drywall & Building Plaster Market include:

- In April 2021, Saint-Gobain added a second plasterboard manufacturing to its Turda factory in northern Romania. This €45 million investment significantly increased Romania’s plasterboard manufacturing capacity to meet rapidly growing local needs and those of Central and Eastern European countries and secure Saint-leadership Gobain’s position in light construction markets.

A list of some of the critical suppliers present in the market is as follows:

- Saint-Gobain

- Etex

- Knauf Gips KG

- Fermacell

- Gyptec Iberica

- National Gypsum Properties

- USG Boral Building Products

- PABCO Building Products

- American Gypsum Company LLC

- ROCKWOOL International A/S

- Continental Building Products

- LafargeHolcim

- Winstone Wallboards Limited

- China National Building Material Company Limited

- Lime Green Products Ltd.

Market Segments Covered in Report

By Product Type:

- Drywall

- Building Plaster

- Gypsum

- Lime

- Cement

By Application:

- Residential

- Wholesale & Retail Buildings

- Offices

- Academic & Educational Buildings

- Hotels & Restaurants

- Others

By Region and Country:

- North America (U.S., Canada)

- Latin America (Brazil, Mexico, Rest of Latin America)

- Europe (Germany, Italy, France, UK, Spain, Netherlands, Norway, Russia, Rest of Europe)

- Asia-Pacific (China, Japan, South Korea, India, Indonesia, Thailand, Vietnam, Australia & New Zealand, Rest of Asia-Pacific)

- Middle East (Saudi Arabia, Turkey, UAE, Rest of Middle East)

- Africa (South Africa, Nigeria, Egypt, Rest of Africa)

Global Drywall & Building Plaster Market 2022-2030: Report Coverage and Highlights

- Assessment of the historical and current market size (2017-2021), market projections (2022-2030), and its contribution to the parent market

- Key drivers, restraints, opportunities, and key emerging trends impacting market growth

- Predictions on critical supply, demand, and technological trends and changes in consumer behavior

- Value chain analysis (list of manufacturers, distributors, end-users, average profitability margins, etc.)

- Segment-wise, country-wise, and region-wise market analysis

- Competition mapping, market share analysis, key strategies adopted by top players, and competitive tactical intelligence

- Key product innovations and regulatory framework

- Covid-19 impact on the market and how to navigate

- Strategic market analysis and recommendations on crucial winning strategies

| Research Scope | Details |

| Forecast period | 2022-2030 |

| Historical data available for | 2017-2021 |

| Market analysis | USD Million for Value and Kilo Tons for Volume, and CAGR from 2022 to 2030 |

| Key regions covered | North America, Latin America, Europe, Asia-Pacific, Middle East, and Africa |

| Key countries covered | US, Canada, Brazil, Mexico, Germany, Italy, France, UK, Spain, Netherlands, Norway, Russia, China, Japan, South Korea, India, Indonesia, Thailand, Vietnam, Australia & New Zealand, Saudi Arabia, Turkey, UAE, South Africa, Nigeria, Egypt |

| Key segments covered | By Type, Application, and Region |

| Customization scope | Available upon Request |

| Pricing and purchase options | Available upon Request |