Global Corrugated Box Market Size Analysis

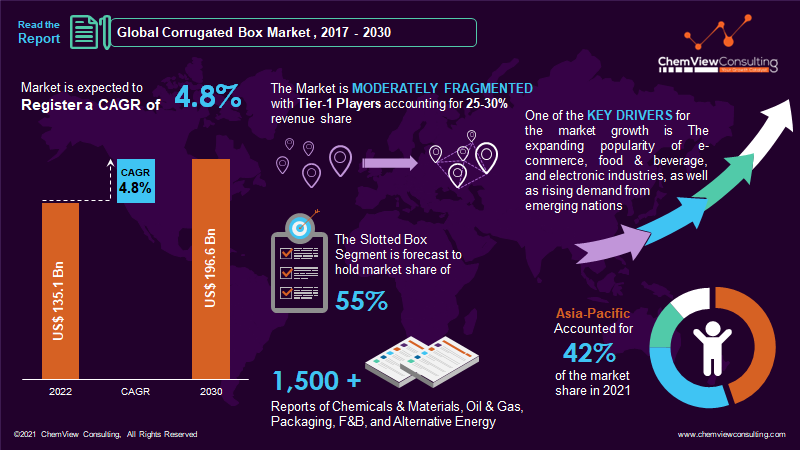

According to a research analysis conducted by ChemView Consulting, in 2022, the worldwide Corrugated Box market was worth US$ 135.1 Bn and is expected to grow at a CAGR of 4.8% over the forecast period. The market is expected to hit US$ 196.6 Bn by 2030 end.

Market Dynamics

- Rise in E-Com Shopping: Corrugated boxes are in high demand all over the world as a result of the online shopping trend. Corrugated boxes come in a variety of forms and sizes, allowing manufacturers to create packaging that is both unique and appealing.

- Advancement in R&D: Increased R&D initiatives to update and improve the chemical resistance, dimension stability, and other qualities of corrugated boxes are expanding its uses. The product uses glassware and ceramics, food and drinks, chemicals, paper, textiles, electronics, personal care, and domestic items.

- Sustainable approach by Consumer: In Central and Eastern Europe, corrugated box packaging integrates a sustainable strategy and eco-friendly material, valued by approximately 80% of the people. In 78% of situations, consumers utilize sustainable corrugated packaging for online purchasing.

Segment-Wise Analysis

Why do slotted boxes hold the highest market share in the Corrugated Box Market?

Slotted boxes account for the greatest section of all corrugated boxes. The market is segmented by type, with slotted boxes, telescope boxes, rigid boxes, and folder boxes among the categories. The slotted boxes category had a commanding position in terms of value and volume. The most popular variety is sewn, taped, or glued together from a single piece of corrugated board.

The blanks or trays are scored and fitted to facilitate folding in this procedure and are subsequently supplied flat to the user. The user must square the box, place the product inside, and seal the flaps before they may be used.

Which Printing Technology is creating the highest demand for Corrugated Box Market?

A wide range of benefits makes flexography an attractive printing technique for packaging printing because it offers quick and economical printing. The printing process applies simple designs and colors to various packaging materials. These include corrugated boxes, plastic containers, tapes, envelopes, and metal foils. Printing on corrugated boxes is most commonly achieved using flexography technology.

Why does Asia-Pacific account for the largest market share in the Corrugated Box Market?

In terms of value, the APAC region is expected to be the largest market. APAC is predicted to expand at the fastest rate during the projected period. The market’s growth is aided by rising demand and supply in the food and beverage, electronics, and personal care industries, notably in China, India, and Japan.

The area’s market is also driven by a large surge in e-commerce business development. The Asia Pacific is also a major industrial hub with a sizable market.

Furthermore, factors such as growing consumer goods demand, innovation in electronics and other industries, and so on are projected to contribute to the region’s growth throughout the predicted period.

Competition Analysis

To remain competitive in the industry, key market players are investing in expanding their market footprint. Several vital players invest a fair share of their revenue in research and development to boost their product portfolio. Market participants focus on technological development and utilizing a product in several applications.

Some key developments:

- In October 2021, Verzuolo was acquired by Smurfit Kappa Group. In 2019, the company converted the PM9 machine into a cutting-edge 661,387-ton recycled containerboard machine due to this acquisition. It supplements the existing and strategically located operational facilities near Savona’s port. This is expected to benefit both the company and its customers.

- In September 2021, Rengo Co., Ltd. announced that its Vietnamese joint venture, Vina Kraft Paper Co., Ltd., had decided to build a new containerboard production site. Vietnam’s total annual demand for containerboard exceeded three million tonnes in 2019 due to continued foreign direct investment, primarily in the export industry and expanding domestic consumption. Vina Kraft Paper is expected to solidify its position as a market leader in the Vietnam containerboard sector, with the newly built mill aiming for long-term development and expansion. It is also expected to strengthen Vietnam’s local integrated containerboard to corrugated box manufacturing system.

- In September 2021, The Mondi Group expanded its corrugated box production plant in Szczecin, Poland, by installing new equipment. This expansion aims to broaden the company’s packaging portfolio and improve manufacturing processes. This expansion is expected to strengthen the company’s position as a preferred e-commerce packaging supplier to Europe’s expanding markets.

- In March 2021, International Paper completed the acquisition of two cutting-edge corrugated box plants in Spain. The acquisition of this company will allow it to expand its capabilities in Madrid and Catalonia. The corrugated box business is critical to the company’s strategy in EMEA. It provides high-quality packaging solutions in the industrial segment, focusing on fruit and vegetable packaging and e-commerce solutions.

A list of some of the key players present in the market are:

- Mondi Group Plc

- Bee Packaing

- DS Smith Packaging Limited

- Oji Holdings Corporation

- Smurfit Kappa Group Plc

- International Paper Company

- WestRock Company

- Georgia Pacific Packaging LLC

- Pratt Industries, Inc.

- Tat Seng Packaging Group

- VPK Packaging Group nv

- STORA ENSO OYJ

- Nelson Container Corporation

- Great Little Box Company Ltd.

- Acme Corrugated Box Co. Inc.

Market Segments Covered in Report

By Board type:

- Single Face Board

- Single Wall Board

- Double Wall Board

- Triple Wall Board

By Grade type:

- Liner

- Fluting Medium

By Product Type:

- Slotted Box

- Folder Box

- Telescope Box

- Die-Cut Box

By Material Type:

- Virgin

- Recycled

By Printing Technology:

- Digital Printing

- Flexography Printing

- Lithography Printing

- Others

By End Use:

- Food

- Beverages

- Electricals & Electronics

- Pharmaceuticals

- Textiles & Apparels

- E-commerce

- Building & Construction

- Personal Care & Cosmetics

- Chemical & Fertilizers

- Others

By Region and Country:

- North America (U.S., Canada)

- Latin America (Brazil, Mexico, Rest of Latin America)

- Europe (Germany, Italy, France, UK, Spain, Netherlands, Norway, Russia, Rest of Europe)

- Asia-Pacific (China, Japan, South Korea, India, Indonesia, Thailand, Vietnam, Australia & New Zealand, Rest of Asia-Pacific)

- Middle East (Saudi Arabia, Turkey, UAE, Rest of Middle East)

- Africa (South Africa, Nigeria, Egypt, Rest of Africa)

Global Corrugated Box market 2022-2030: Report Coverage and Highlights

- Assessment of the historical and current market size (2017-2021), market projections (2022-2030), and its contribution to the parent market

- Key drivers, restraints, opportunities, and key emerging trends impacting market growth

- Predictions on critical supply, demand, and technological trends and changes in consumer behavior

- Value chain analysis (list of manufacturers, distributors, end-users, average profitability margins, etc.)

- Segment-wise, country-wise, and region-wise market analysis

- Competition mapping, market share analysis, key strategies adopted by top players, and competitive tactical intelligence

- Key product innovations and regulatory framework

- Covid-19 impact on the market and how to navigate

- Strategic market analysis and recommendations on crucial winning strategies

| Research Scope | Details |

| Forecast period | 2022-2030 |

| Historical data available for | 2017-2021 |

| Market analysis | USD Million for Value and Tons for Volume, and CAGR from 2022 to 2030 |

| Key regions covered | North America, Latin America, Europe, Asia-Pacific, Middle East, and Africa |

| Key countries covered | US, Canada, Brazil, Mexico, Germany, Italy, France, UK, Spain, Netherlands, Norway, Russia, China, Japan, South Korea, India, Indonesia, Thailand, Vietnam, Australia & New Zealand, Saudi Arabia, Turkey, UAE, South Africa, Nigeria, Egypt |

| Key segments covered | Material Type, Board Type, Grade Type, Product Type, End-Use, and Region |

| Customization scope | Available upon Request |

| Pricing and purchase options | Available upon Request |