Alternative Protein Market Size Analysis

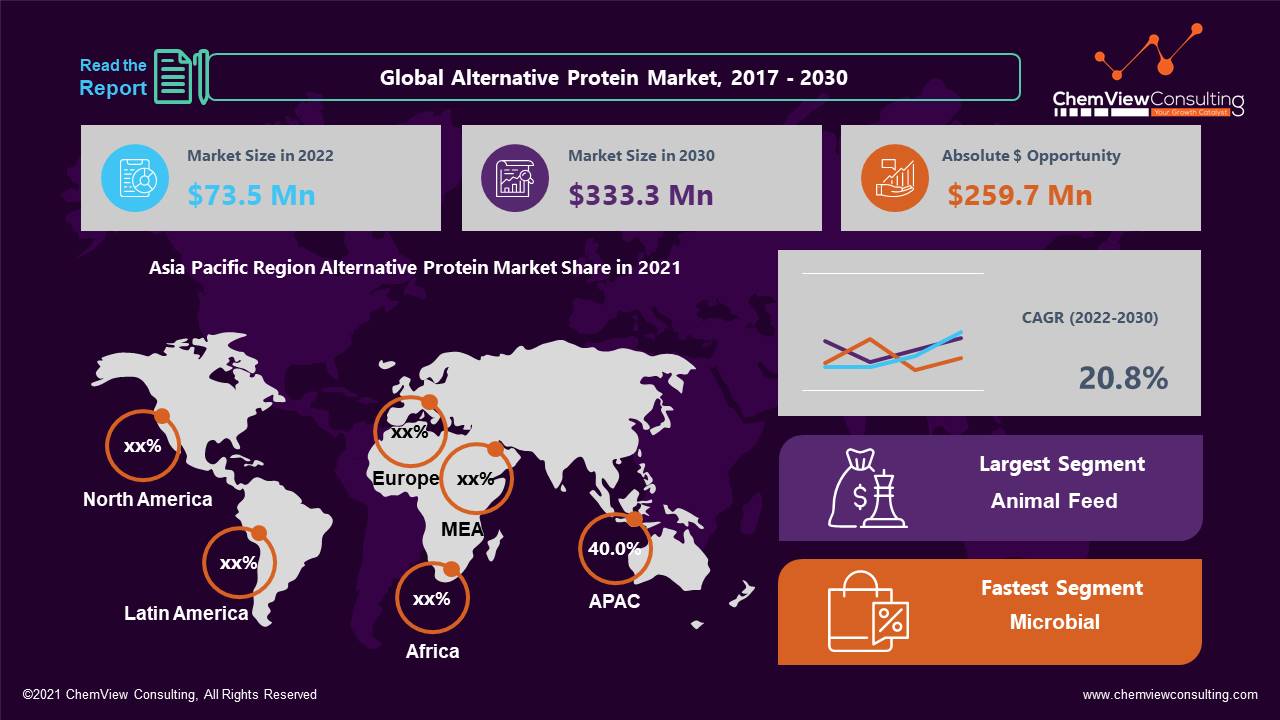

According to a research survey conducted by ChemView Consulting, in 2022, the Global Alternative Protein Market was worth US$ 73.5 Bn and is expected to grow at a CAGR of 20.8% over the forecast period. The market is expected to hit US$ 333.3 Bn by 2030 end.

The increased need for nutritional demands for the cattle sector and people can be related to the growth of the alternative protein market.

Non-meat proteins derived from plants, fungi, and insects are examples of alternative proteins. Alternative proteins, such as meat analogs and different animal feed products, are employed in dairy-free dishes and meat-free diets.

Consumers have expressed a strong interest in health, ethical issues, and low protein calorie consumption to maintain a healthy lifestyle regularly.

Market Dynamic

CONSUMERS’ FOCUS ON SUSTAINABILITY AND INCREASED HEALTH CONCERNS DRIVE THE MARKET

Alternative protein is significant in the livestock industry since it is used to feed a variety of species, including cattle, aquaculture, poultry, swine, pet food, and horse. The increased emphasis on decreasing the total cost of feed has resulted in increased demand for alternative protein sources for animal feed, which is likely to drive the alternative protein market share. Because of the high amino acid and vitamin content of plant-based proteins, alternative protein is a valuable source for animal feed.

Consumers’ focus on sustainability, increased health concerns, and a desire for exceptional flavor in meat analogs are a few of the factors driving demand for meat analogs, which is predicted to affect the growth of the alternative protein industry favorably.

ALLERGIES RELATED TO ALTERNATIVE PROTEINS AND STRINGENT GOVERNMENTAL REGULATIONS HAMPER THE MARKET GROWTH

Allergies to alternative proteins, such as plant-based and insect-based proteins, impede market expansion. Furthermore, strict feed regulatory compliances for the livestock industry hinder market expansion.

Despite the availability of a wide range of proteins on the market, not all are safe for use in the cattle business or by people. It results in significant investments in the hunt for alternative proteins for various animal species. Even though the lactose-intolerant population is requesting alternative proteins, most customers are still getting used to the taste of the proteins. All of these issues are limiting the market’s expansion.

COVID-19 Impact

The COVID-19 epidemic has caused several enterprises to downsize, slowing the growth of the Alternative proteins sector. However, demand for Alternative protein products has not been reduced because of the increased adoption of a healthy lifestyle and eating habits during the shutdown. Rising knowledge of good eating practices has resulted in a more protein-rich diet, which aids in muscle development and immunity. It limits the negative impact of the pandemic on market growth.

Segment-Wise Analysis

Why is it predicted that microbial-based protein type Alternative Protein would rise at the quickest CAGR?

In 2021, microbial-based protein accounted for 40.0% of the market. Bacteria, algae, yeast, and fungus are all microbial protein sources commonly employed in food applications.

These are commonly utilized in dietary supplements because they are a good source of vitamins, carotenes, and carbs, which should increase the demand for microbial-based protein. Microbial-based proteins are nutritious protein sources employed in various functional foods and drinks, which is projected to drive the growth of the alternative protein market.

Why is the Animal Feed segment expected to expand the fastest during the forecast period?

Animal feed accounts for 55.0% of the market in 2021 and is predicted to be the greatest contributor to the alternative protein industry. It is due to the demand for the unique nutritional needs of animals.

Protein alternatives for animals are in high demand, from plant-based pet food to alternative proteins for aquaculture. Alternative protein manufacturers focus on generating breed and species-specific proteins to get better outcomes.

Region-Wise Analysis

The regions analyzed for the market include North America, Europe, Latin America, Asia Pacific, Middle East, and Africa.

- Consumers in North America are worried about the substances used in food goods. When deciding on alternative proteins, sustainability and health consequences are important considerations.

- Rising demand for nutritional components and increased consumer interest in preventative healthcare are propelling alternative protein sales, particularly in the United States and Canada.

- The cattle business in the European area is helping to build the alternative protein market. Veganism is becoming more popular in Europe. People in the United Kingdom and Germany have shown an interest in investing in plant-based protein. Plant proteins derived from soy, peas, lentils, chickpeas, and almonds have found their way into the European market.

- Due to a large rise in per capita income, Asia-Pacific is predicted to expand at a significantly stable rate throughout the projection period. As a result, people have increased their protein intake in their usual diet. Furthermore, fast expansion in nations’ food processing industries will likely fuel market revenue growth.

Competition Analysis

The global alternative protein market for food applications is highly fragmented, with numerous multinational corporations and regional players. Market participants are concentrating on cooperating for tactics such as collaborations, product launches, mergers and acquisitions, and acquisitions for applications such as food and animal feed.

Some of the key developments that have taken place in the Alternative Protein Market include:

- In December 2022, Vestkorn Miling, Europe’s top manufacturer of pea and bean-derived products, was acquired by Royal DSM NV. The firm is concentrating on extending its alternative protein portfolio with this purchase.

- In April 2021, Archer Daniels Midland announced opening a new and innovative research lab in Singapore dedicated entirely to plant-based protein research. The new facility will assist the firm in increasing the commercial manufacture of alternative protein and meeting the rising demand from the Asia Pacific food and beverage sector.

A list of some of the key suppliers present in the market are:

- Cargill Incorporation

- Royal DSM NV

- AMCO Proteins

- Puris

- Axiom Foods

- Darling Ingredients

- Innovafeed

- Lallemand Inc.

- Hamlet Protein

- Archer Daniel Midland Company

- AB Mauri

- Soja Protein

- Ingredion

- Ynsect

- Angel Yeast

- Calysta Inc.

Market Segments Covered in Report

By Source:

- Insect-based Alternative Protein

- Microbial-based Alternative Protein

- Bacteria

- Yeast

- Algae

- Fungi

- Others

- Plant-based Alternative Protein

- Soy Protein Isolates

- Soy Protein Concentrates

- Fermented Soy Protein

- Duckweed Protein

- Others

- Other Alternative Protein Sources

By Application:

- Food & Beverage

- Cattle

- Aquaculture

- Animal Feed

- Pet Food

- Equine

- Other Applications

By Region and Country:

- North America (U.S., Canada)

- Latin America (Brazil, Mexico, Rest of Latin America)

- Europe (Germany, Italy, France, UK, Spain, Netherlands, Norway, Russia, Rest of Europe)

- Asia-Pacific (China, Japan, South Korea, India, Indonesia, Thailand, Vietnam, Australia & New Zealand, Rest of Asia-Pacific)

- Middle East (Saudi Arabia, Turkey, UAE, Rest of Middle East)

- Africa (South Africa, Nigeria, Egypt, Rest of Africa)

Global Alternative Protein Market 2022-2030: Report Coverage and Highlights

- Assessment of the historical and current market size (2017-2021), market projections (2022-2030), and its contribution to the parent market

- Key drivers, restraints, opportunities, and key emerging trends impacting market growth

- Predictions on critical supply, demand, and technological trends and changes in consumer behavior

- Value chain analysis (list of manufacturers, distributors, end-users, average profitability margins, etc.)

- Segment-wise, country-wise, and region-wise market analysis

- Competition mapping, market share analysis, key strategies adopted by top players, and competitive tactical intelligence

- Key product innovations and regulatory framework

- Covid-19 impact on the market and how to navigate

- Strategic market analysis and recommendations on crucial winning strategies

| Research Scope | Details |

| Forecast period | 2022-2030 |

| Historical data available for | 2017-2021 |

| Market analysis | USD Billion for Value and Tons for Volume, and CAGR from 2022 to 2030 |

| Key regions covered | North America, Latin America, Europe, Asia-Pacific, Middle East, and Africa |

| Key countries covered | US, Canada, Brazil, Mexico, Germany, Italy, France, UK, Spain, Netherlands, Norway, Russia, China, Japan, South Korea, India, Indonesia, Thailand, Vietnam, Australia & New Zealand, Saudi Arabia, Turkey, UAE, South Africa, Nigeria, Egypt |

| Key segments covered | By Source, Application, and Region |

| Customization scope | Available upon Request |

| Pricing and purchase options | Available upon Request |